Our collection of resources based on what we have learned on the ground

Resources

infographic

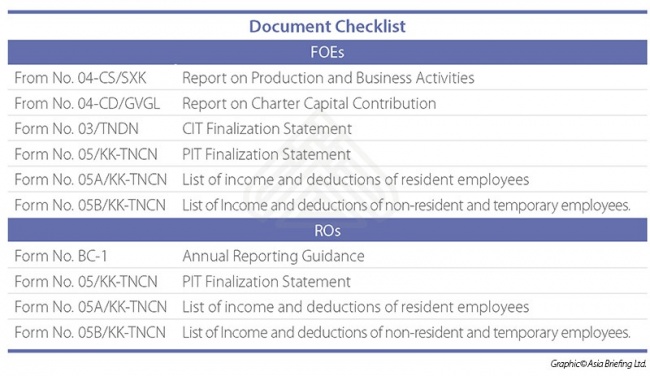

Document Checklist for Foreign Owned Enterprises and Representative Offices for ...

- January 2016

- Free Access

The requisite documentation needed for FOEs and ROs in the auditing process in Vietnam.

infographic

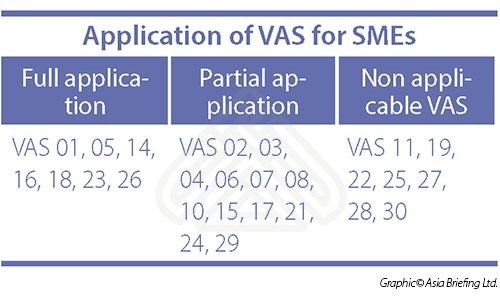

Application of Vietnamese Accounting Standards for Small and Medium Sized Enterp...

- January 2016

- Members Access

Vietnam requires that SMEs comply with a simplified set of accounting standards.

magazine

Annual Audit and Compliance in China 2016

- November 2015

- Members Access

In this issue of China Briefing, we provide a comprehensive analysis of the various annual compliance procedures that foreign invested enterprises in China will have to follow, including wholly-foreign owned enterprises, joint ventures, foreign-inves...

magazine

Bestimmungen zu Verrechnungspreisen in Asien

- October 2015

- Members Access

China hat Anfang dieses Jahres weitere zwingende Auflagen an Verrechnungspreise für ausländische Firmen aufgestellt. Insbesondere die Priorität eines aussagekräftigen Funktionsnachweis, welcher Verrechnungen über Staatsgrenzen hinweg g...

Q&A

What are some of the advantages of setting up a Liaison Office in India?

- June 2015

- Members Access

Liaison Offices (LOs) in India function as a communication channel between the parent companies abroad and the local companies. They promote the parent companies’ brand and businesses in the local market whilst overseeing their manufacturing pr...

Q&A

What is a ?red invoice,? and what is their significance to commercial operations...

- June 2015

- Free Access

Simply put, a “red invoice” is the nickname given to Vietnam’s Value Added Tax (VAT) invoices. Such invoices are mandated to undertake commercial activities such as the sale of goods and services, imports of foreign goods, and expor...

Q&A

How many types of Value Added Tax (VAT) invoices exist in Vietnam, and what are ...

- June 2015

- Free Access

In Vietnam, the tax system supports self-printed Value Added Tax (VAT) invoices, e-invoices, ordered invoices, and invoices purchased from the local Municipal Taxation Department. Enterprises within hi-tech parks and economic development zones, along...

Q&A

What are the differences between the Chinese Accounting Standard (CAS) and the I...

- May 2015

- Free Access

Despite the ongoing convergence towards international standards, one must be aware of the following differences: Choosing a valuation method; China Accounting Standards (CAS) only allows fixed assets to be valued according to their historical cost...

Q&A

What are the expectations for the Generally Accepted Accounting Practices (GAAP)...

- May 2015

- Free Access

The 2014 Generally Accepted Accounting Practices (GAAP) is expected to be adopted by all medium and large-sized enterprises across Mainland China. The new PRC GAAP consists of: One basic standard providing guidance on practical issues 41 specific...

Q&A

What is 'mapping' in China?

- May 2015

- Free Access

As foreign companies follow different standards, the information from the Chinese subsidiary must be translated to fit into overseas parent company books. This procedure is known as mapping. There are two points to consider: 1. The divergence of Ch...

Q&A

How is accounting currency determined in China?

- May 2015

- Free Access

When a company chiefly does business in non-local currency, it then may choose the currency in which to conduct its accounting. When choosing currency, the company must consider the following factors: If the currency influences the sales pri...

Q&A

What procedures must be considered for before repatriating profits in China?

- May 2015

- Free Access

The remitting of profits does not need prior approval from the State Administrative of Foreign Exchange (SAFE). However it must show that all income taxes have been paid. The investor must present the following documents to the bank in order to prove...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us