Our collection of resources based on what we have learned on the ground

Resources

Q&A

Which types of entities are required to file annual income tax returns by the In...

- April 2015

- Free Access

According to the 1961 Income Tax Act, all legal persons (including corporations, individuals, trusts, and partnerships) must file an annual income tax return in India. For the majority of companies, the fiscal year officially ends on March 31st, and ...

Q&A

What are the key differences between the new India Accounting Standards (Ind-AS)...

- April 2015

- Free Access

While the India Accounting Standards (Ind-AS) represent a major step towards international best practices of financial reporting, many key differences remain between Ind-AS and international financial reporting standards (IFRS). For instance, Ind-AS ...

infographic

China Accounting Quick Facts

- April 2015

- Members Access

China Accounting Quick Facts that include accounting standards, accounting licenses, regulators, the fiscal/financial year, repatriating funds and liability.

Q&A

What are the new India Accounting Standards (Ind-AS) as of 2015, and what impact...

- April 2015

- Free Access

The new India Accounting Standards (Ind-AS) are an updated set of accounting standards put forward by the Institute of Chartered Accountants in India (ICAI) to bring India’s generally accepted accounting practices (GAAP) closer in line with int...

magazine

Managing Your Accounting and Bookkeeping in India

- April 2015

- Members Access

In this issue of India Briefing Magazine, we spotlight three issues that financial management teams for India should monitor. In the first article, we examine the new Indian Accounting Standards (Ind-AS) system, which is expected to be a boon for for...

magazine

Managing Your Accounting and Bookkeeping in China

- April 2015

- Members Access

In this issue of China Briefing, we shed light on the practice of accounting in China. We start out by introducing the reader to the development of the Chinese accounting standards, and their main differences compared to international standards. Next...

infographic

Key Differences between the International Financial Reporting Standards (IFRS) a...

- April 2015

- Free Access

This infographic displays the key differences between the International Financial Reporting Standards (IFRS) and Indian Accounting Standards (Ind-AS).

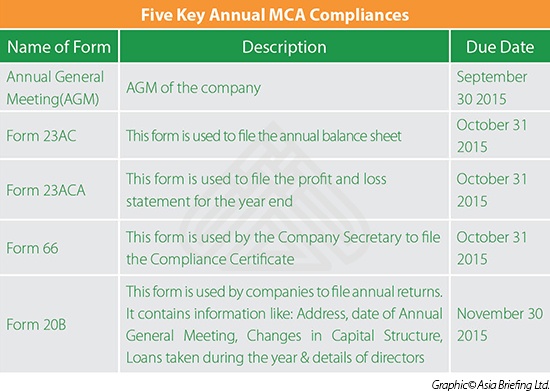

infographic

Five Key Annual Compliances required by India's Ministry of Corporate Affairs (M...

- April 2015

- Free Access

This infographic shows five key annual compliances required by India's Ministry of Corporate Affairs (MCA)

videographic

Comparison of Indian Accounting Standards (Ind-AS) and International Financial R...

- March 2015

- Free Access

This prezi compares different aspects of the Indian Accounting Standards and the commonly used International Financial Reporting Standards.

videographic

Annual Accounting Compliance Requirements

- March 2015

- Free Access

This complicated topic is clarified in this prezi as well as describes the requirements for the procedures

videographic

Compliance Anforderungen in China

- March 2015

- Free Access

Das komplizierte Verfahren wird in dieser Prezi dargestellt.

magazine

Using India's Free Trade & Double Tax Agreements

- February 2015

- Members Access

In this issue of India Briefing magazine, we take a look at the bilateral and multilateral trade agreements that India currently has in place and highlight the deals that are still in negotiation. We analyze the countryâs double tax agreements, ...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us