Our collection of resources based on what we have learned on the ground

Resources

Q&A

How should a foreign enterprise prepare an audit report in China?

- May 2014

- Members Access

All foreign-invested enterprises (FIE), including wholly foreign owned enterprises (WFOE), joint ventures (JV), and foreign-invested commercial enterprises (FICE), are required to hire external accounting firms to conduct and annual audit of the comp...

Q&A

What is the Chinese equivalent of the Generally Accepted Accounting Principles o...

- May 2014

- Members Access

The Chinese Accounting Standards (CAS) framework is based on two standards: the Accounting Standards for Business Enterprises (ASBEs) and Accounting Standards for Small Business Enterprises (ASSBEs). For most enterprises established in China, ASBEs a...

Q&A

What are the required documents representative offices (ROs) need to provide to ...

- May 2014

- Free Access

ROs are required to complete an AIC annual inspection between March 1 and June 30. Generally the following documents should be provided: Annual inspection report (the template will be distributed by AIC around March) Business registration certifi...

Q&A

Do representative offices (ROs) need to complete a tax reconciliation report of ...

- May 2014

- Free Access

ROs are obliged to complete a tax reconciliation report of CIT as part of their annual compliance. The report should be submitted to its local tax bureau by May 31. Usually an audit report is not required for ROs paying CIT based on a deemed profit s...

Q&A

Why is successful audit & compliance crucial to a foreign-invested entity?s (FIE...

- May 2014

- Members Access

External audit is crucial to FIEs because it provides more accurate financial information, and a review through an outsider’s eye can more effectively dig out flaws in the company’s internal control and financial data. It is also a goo...

Q&A

Which R&D expenses are deductible from a company?s taxable income in China?

- May 2014

- Members Access

The following R&D expenses are deductible from a company’s taxable income in China: Basic pension, basic medical insurance, unemployment insurance, work-related injury insurance, maternity insurance and housing funds contributed by the e...

Q&A

What is the corporate income tax (CIT) treatment on cross-border secondment of e...

- May 2014

- Members Access

When a non-resident enterprise (NRE) dispatches personnel to China to provide services, and the NRE normally examines and assesses the performance of the dispatched personnel, and is wholly or partially responsible for their performance, the NRE will...

infographic

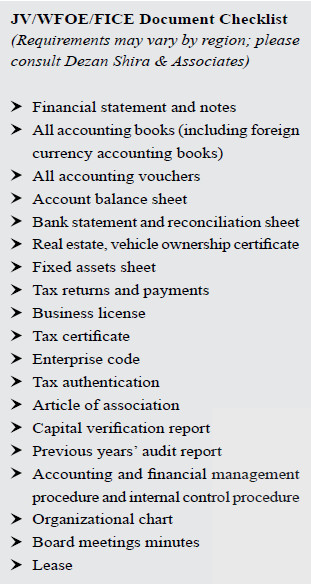

Joint Venture (JV), Wholly Foreign-Owned Enterprise (WFOE) and Foreign-Invested ...

- January 2014

- Free Access

Document Checklist for Joint Venture (JV), Wholly Foreign-Owned Enterprise (WFOE) and Foreign-Invested Commercial Enterprise (FICE) in China

infographic

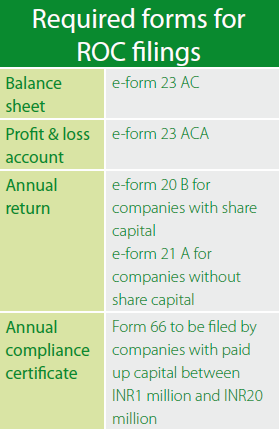

Required Forms for Registrar of Companies Filings in India

- January 2014

- Members Access

Four forms are required to be filled when registering companies in India.

podcast

Vietnam Briefing Magazine, February 2014 Issue: ?A Guide to Understanding Vietna...

- January 2014

- Free Access

This issue of Vietnam Briefing aims to clarify the entire VAT, short for value-added tax, process by taking you through an introduction as to what VAT is, liabilities that come with it, and how to pay it properly.

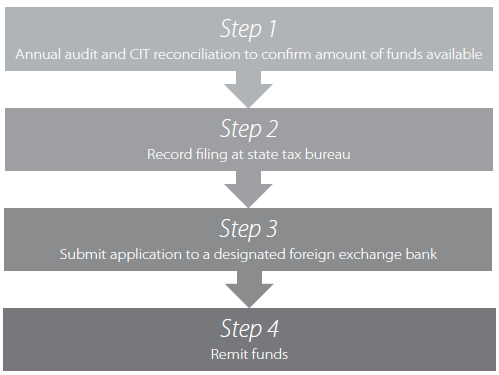

infographic

Profit Repatriation Procedure in China

- January 2014

- Members Access

All foreign-invested enterprises in China are required to carry out annual compliance procedures as mandated by various governmental departments. Here are the steps for profit repatriation in China.

podcast

Introduction to ASEAN Briefing presented by Chris Devonshire-Ellis

- May 2013

- Free Access

Chris Devonshire-Ellis, Founder of Dezan Shira & Associates, introduces the ASEAN Briefing website. This new website is dedicated to the various and increasing number of trade treaties and agreements throughout the ASEAN region.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us