Our collection of resources based on what we have learned on the ground

Resources

Q&A

Welche Vorteile bietet ASEAN?

- October 2014

- Free Access

ASEAN gilt als wachsende Wirtschaftszone mit viel Kapazitäten und Möglichkeiten im Verkauf und Handel. Unternehmen genießen nicht nur Steuer- und Zollfreiheit, sondern auch Vorteile des Freihandels- und Doppelbesteuerungsabkommen, welche derzeit m...

presentation

Expatriate China Social Insurance, BT to VAT Conversion and Fund Repatriation

- September 2014

- Members Access

This tax workshop led by Senior Manager Hannah Feng and Partner Sabrina Zhang will take you through an overview of the regulatory systems on social insurance, mandatory benefits, corporate income and value-added taxes, and profit repatriation in Chin...

presentation

An Introduction to the Chinese Social Security System and the Participation of F...

- September 2014

- Free Access

Adam Livermore, Payroll and HR Admin Manager, presents an overview of the Chinese social security system, the obligations for the employer, the benefits that can be claimed, and the issues relating to impending participation of foreigners under the c...

infographic

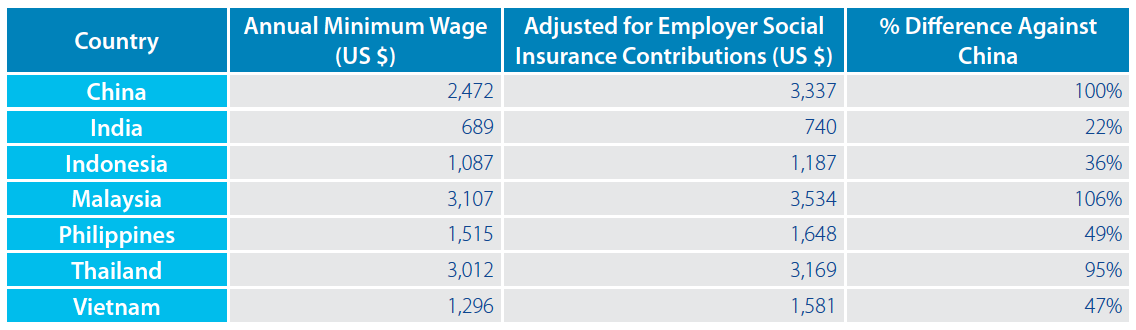

Comparison between China wages with other Asian countries

- July 2014

- Free Access

This infographic details the different amount of minimum wage across countries in Asia and draws comparisons with China.

presentation

Mandatory Benefit Administration and Payroll Processing in China

- May 2014

- Members Access

A presentation by Adam Livermore, Partner and Regional Manager, demonstrating a typical payroll processing implementation, the usage of dispatch agreements and the responsibilities of the employer with regards to the mandatory benefits system in Chin...

presentation

An Introduction to Social Welfare in China and Its Potential Effect on Foreign E...

- May 2014

- Members Access

A presentation by Adam Livermore, Partner and Regional Manager, outlining the current situation in China regarding insurance, mandatory benefits and pensions.

presentation

Payroll Processing and HR Administration

- May 2014

- Free Access

Adam Livermore, Partner and Regional Manager, discusses outsourced payroll processing procedures and services as well as HR administration services.

presentation

Explaining the Monthly Payroll Process in China: What Does Your HR Manager Reall...

- May 2014

- Free Access

This presentation by Adam Livermore, Payroll & HR Admin Manager, will draw a practical guide on monthly payroll processing for your business in China from a HR manager perspective.

Q&A

Do female employees get paid maternity leave in China?

- May 2014

- Free Access

The Special Provisions on Labor Protection of Female Workers promulgated by the Chinese State Council on April 28, 2012, state that a pregnant female employee should be given 98 days of maternity leave, of which 15 days can be taken prior to givin...

Q&A

What are the regulations regarding unemployment insurance in China?

- May 2014

- Free Access

Employers should contribute 2 percent of the total salary paid to its employees to the unemployment insurance fund, while employees should pay 1 percent of their own wages to the fund. The Unemployment Insurance Regulations provide that the amount o...

Q&A

When is a person eligible to collect unemployment insurance compensation in Chin...

- May 2014

- Free Access

An unemployed person that meets the following conditions can collect unemployment insurance compensation: Both the employer and the unemployed person have paid unemployment insurance premiums for one year before the person became unemployed; The ...

Q&A

How does an employee in China apply for the benefits of the work-related injury ...

- May 2014

- Free Access

Employees should submit work injury determination applications with the social insurance administration department within 30 days of the accident or of being diagnosed with an occupational disease, and are required to show proof of the employment rel...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us