Our collection of resources based on what we have learned on the ground

Resources

infographic

Corporate Taxes in Hong Kong

- January 2014

- Members Access

Introduction to Corporate Taxes in Hong Kong. The value-added tax and standard tax on dividends are 0% in Hong Kong.

infographic

Total Dividend Tax for Direct Investment vs HK Holding Co. in China

- January 2014

- Members Access

Total Dividend Tax for Direct Investment is 10%, while for HK Holding Co.is 5% in China.

infographic

Individual Income Tax Rate in Hong Kong

- January 2014

- Members Access

In Hong Kong, salaries tax payable is the lower of two calculation methods.

infographic

Hong Kong e Singapore: possibili holdings per investimenti in Asia?

- December 2013

- Free Access

Tassazione a confronto: Hong Kong e Singapore

infographic

Key Tax Rates in Hong Kong

- July 2013

- Free Access

The table shows the different tax rates in Hong Kong.

infographic

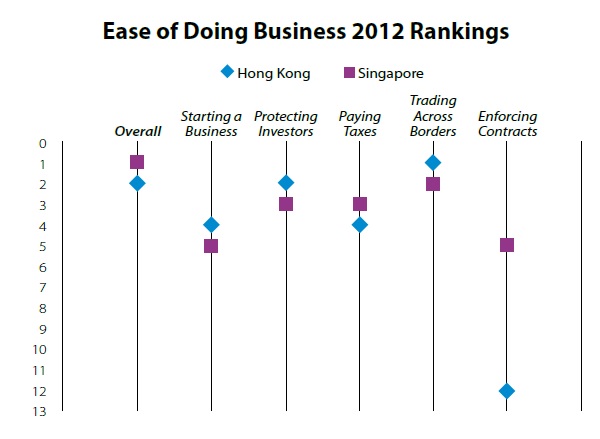

Ease of Doing Business in Hong Kong and Singapore

- May 2012

- Free Access

The graph compares the ease of doing business in Hong Kong and Singapore.

infographic

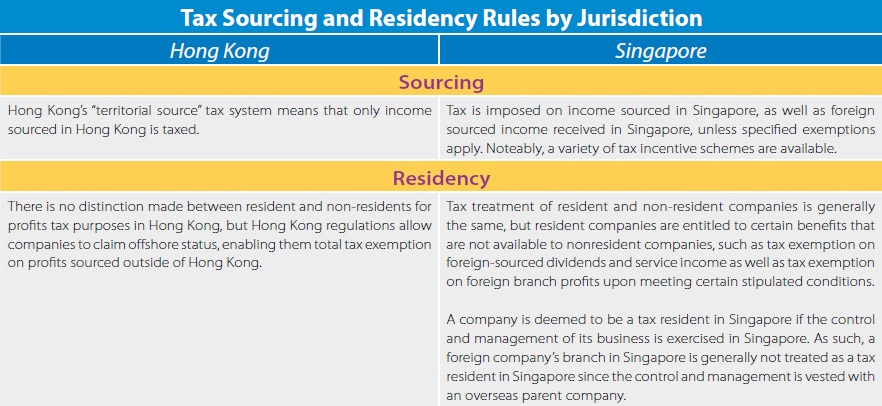

Tax Sourcing and Residency Rules in Hong Kong and Singapore

- May 2012

- Free Access

The table shows the differences of tax sourcing and residency rules by jurisdiction between Hong Kong and Singapore.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us