Our collection of resources based on what we have learned on the ground

Resources

infographic

Tax Liabilities During Liquidation in China

- June 2012

- Members Access

The table shows the tax liabilities and liability calculations during liquidations of a foreign-invested enterprise in China.

magazine

Spostare la sede legale ed espandere le proprie attività in Cina

- June 2012

- Members Access

La scelta di spostare la sede legale della propria attività in Cina puoâ avvenire per varie ragioni: un cambio nel modello di business, lâentrata in nuovi mercati, unire investimenti che prima erano âseparatiâ, la ricerca di mi...

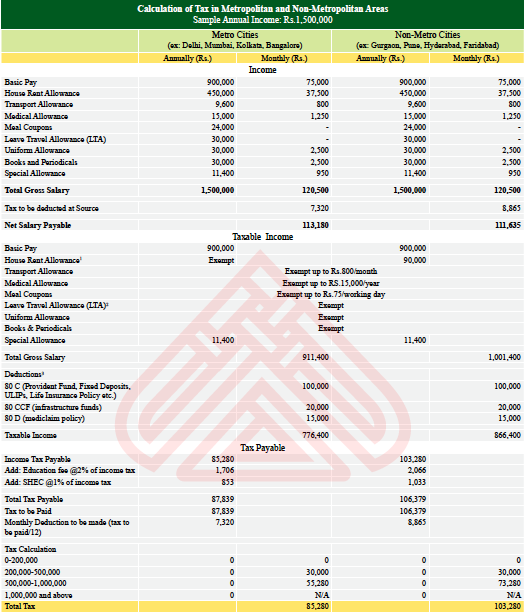

infographic

Tax Calculation for Different Areas in India

- June 2012

- Members Access

Calculation of Tax in Metropolitan and Non-Metropolitan Areas in India.

guide

Doing Business in Vietnam

- May 2012

- US $8.99

Earlier in its development process than many countries, Vietnam is learning from other countriesâ reform experiences and utilizing its late mover advantage in technology introduction. As labor costs rise elsewhere, many investors look to Vietnam...

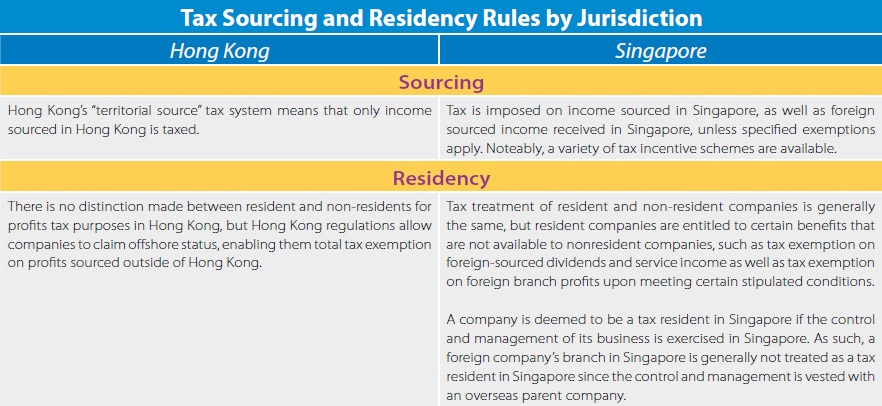

infographic

Tax Sourcing and Residency Rules in Hong Kong and Singapore

- May 2012

- Free Access

The table shows the differences of tax sourcing and residency rules by jurisdiction between Hong Kong and Singapore.

magazine

Compañías holding en Hong Kong y Singapur

- May 2012

- Members Access

En esta edición del China Briefing, veremos más de cerca los beneficios de las compañÃas holding tanto de Hong Kong como de Singapur, la forma de establecer y mantener una compañÃa en cada una de estas jurisdicciones, y los acuerdos...

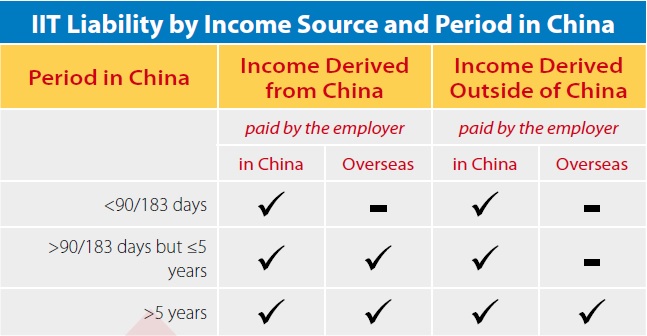

infographic

Individual Income Tax (IIT) Liabilities for Senior Personnel in China

- April 2012

- Free Access

The table shows the Individual Income Tax (IIT) liabilities by income source and period in China for senior personnel.

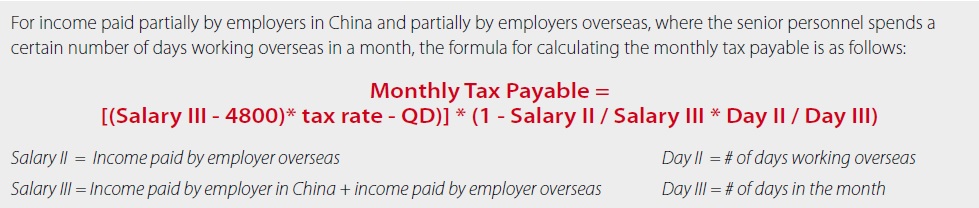

infographic

Individual Income Tax (IIT) Formula for Senior Personnel in China

- April 2012

- Members Access

The formula shows the calculation of the individual income tax (IIT) for employee who's income paid partially by employers in China and partially by employers oversea.

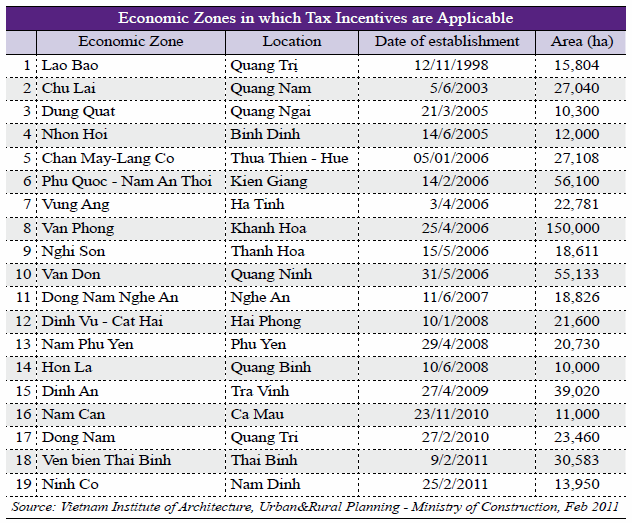

infographic

Tax Incentives for Economic Zones in Vietnam

- January 2012

- Free Access

The table outlines the location, date of establishment and area of the economic zones in Vietnam, which tax incentives are applicable.

magazine

Declaración anual para empresas de inversión extranjera

- January 2012

- Members Access

Previamente a la distribución y repatriación de beneficios, las empresas de inversión extranjera (FIEs) deben completar el procedimiento de declaración anual, que incluye una auditorÃa, la declaración de impuestos y una inspecció...

magazine

Revisione Contabile e Verifiche Annuali per Società e Persone Straniere in Cina

- January 2012

- Members Access

Gli appuntamenti di gennaio e febbraio sono solitamente, in Cina, i banchetti del capodanno lunare, i mezzi di trasporto in tilt e... le verifiche annuali di conformità fiscale.

magazine

Jährliche Compliance für ausländisch investierte Unternehmen (FIEs)

- January 2012

- Members Access

Bevor Gewinne verteilt oder rückgeführt werden können, müssen ausländisch investierte Unternehmen zunächst ihren jährlichen Compliance-Verpflichtungen nachkommen. In diesem Magazin führen wir Sie Schritt für Schritt durch d...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us