Our collection of resources based on what we have learned on the ground

Resources

infographic

Individual Income Tax Rate in India

- January 2014

- Members Access

India imposes different sets of progressive tax rates, ranging from 10-30 percent.

infographic

Individual Income Tax Rate in Vietnam

- January 2014

- Members Access

In Vietnam, personal income is taxed according to seven progressive rates from 5 to 35 percent.

infographic

Major Advantages for Using Wholly-Owned Subsidiaries in India

- January 2014

- Free Access

Eight Advantages for Using Wholly-Owned Subsidiaries in India

infographic

Key Features of Different Entities under Indian Law

- January 2014

- Free Access

For different entities, key features are different under Indian Law.

infographic

Types of Permanent Establishment under Indian Law

- January 2014

- Free Access

There are three types of permanent establishment under Indian law: Fixed Place PE, Agency PE, and Service PE.

infographic

Seven Factors Disfavorable to Being Named a Beneficial Owner in China

- January 2014

- Free Access

There are seven factors disfavorable to being named a beneficial owner in China.

infographic

Treaty Benefit Administrative Requirements by Income Type in China

- January 2014

- Free Access

For passive income and active income, the treaty benefit administrative requirements are different in China.

infographic

Equity Transfer, Notification Documentation in China

- January 2014

- Free Access

When establishing an offshore holding company, four parts need to be included in the notification.

infographic

China's Tax System of 2012

- January 2014

- Members Access

Current tax system in China consists of two parts: value added tax and business tax.

infographic

Value Added Tax (VAT) Calculation in China

- January 2014

- Free Access

Value added tax (VAT) calculation in China consists of two parts: output VAT and input VAT.

infographic

Automatic and Governmental-Approval Routes for FDI in India

- January 2014

- Free Access

FDI in India can be done through two routes-the automatic route and the government route- with most done through the former.

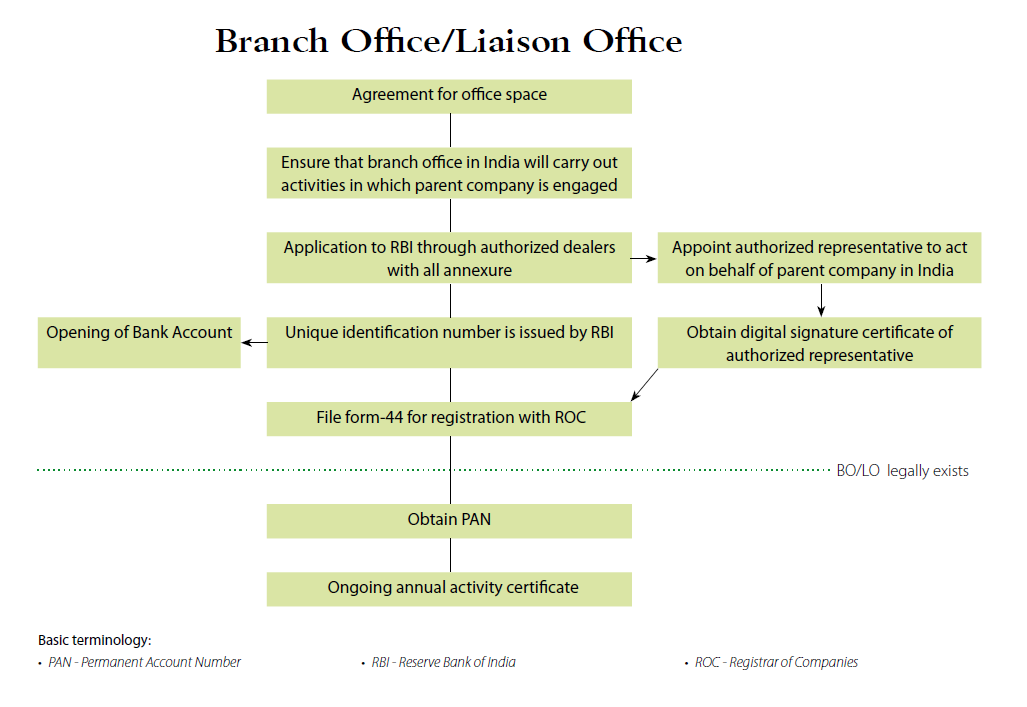

infographic

Setting up a Branch or Liaison Office in India

- January 2014

- Free Access

A flowchart showing the necessary steps to set up a branch or liaison office in India.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us