Our collection of resources based on what we have learned on the ground

Resources

Q&A

What is a “letter of intent” and what should be done after initial investiga...

- June 2016

- Members Access

A “letter of intent” aims to outline the matters that the two parties are going to discuss and lay out the complete procedures for doing so. It is then crucial for both parties to employ an asset evaluation agency which is established und...

Q&A

What should a company do after signing an acquisition agreement?

- June 2016

- Members Access

Investors should apply for the “Certificate of Approval for Foreign Investment” from MOFCOM or its local level branches according to the investment amount, type of enterprise, and the industry to be invested. In addition, verification by ...

Q&A

Which party is responsible for registering new business licenses and what are th...

- June 2016

- Members Access

After receiving the approval certificate from MOFCOM, foreign investors engaged in asset acquisitions have 30 days to register the acquired domestic enterprise as a foreign-invested enterprise(FIE) with the SAIC or its local branches. On the other ha...

Q&A

How is Corporate Income Tax determined for acquired companies in China?

- June 2016

- Members Access

Under the PRC Corporate Income Tax (CIT) Law, which applies to both domestic enterprises as well as foreign and foreign-invested enterprises, income arising from the transfer of equity and assets (both fixed and intangible) is subject to CIT. While a...

presentation

Navigating Complexities: An Introduction to Dezan Shira & Associates in India

- June 2016

- Free Access

This report offers an introduction to Dezan Shira & Associates business services and information platforms for companies seeking to establish themselves in India.

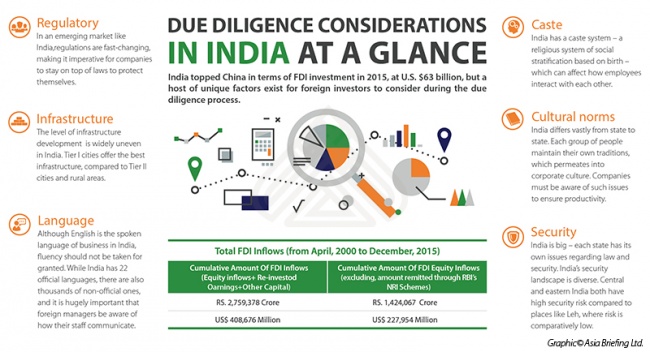

infographic

Due Diligence Considerations in India at a Glance

- May 2016

- Members Access

India has successfully topped China in terms of FDI investment in 2015, a unique due diligence factors have to be considered during the process.

infographic

Regulatory Due Diligence in India

- May 2016

- Members Access

Brief three main points of what a foreign company should be aware of when performing due diligence in India.

Q&A

How can the due diligence process help a foreign investor to traverse the Indian...

- May 2016

- Members Access

A company’s success is in turn linked to the risk management and mitigation strategy that it undertakes. It is in this regard that due diligence becomes a powerful tool that companies may utilize when dealing with Indian businesses. Due diligen...

Q&A

Why should companies conduct due diligence in India?

- May 2016

- Members Access

There are two primary reasons why a company should conduct due diligence in India. Firstly, a company that plans to trade with an Indian company should verify that the business is what it appears to be. This is vital in India because several companie...

magazine

Pre-Investment Due Diligence in India

- May 2016

- Members Access

In this issue of India Briefing Magazine, we examine issues related to pre-investment due diligence in India. We highlight the different regulatory, tax, and socio-economic issues that a company should be aware of before entering the Indian market. W...

magazine

How IT is Changing Payroll Processing and HR Admin in China

- April 2016

- Members Access

In this edition of China Briefing magazine, we examine how foreign multinationals can take better advantage of IT in the gathering, storing, and analyzing of HR information in China. We look at how IT can help foreign companies navigate China’s nua...

Q&A

What are some common licensing requirements that investors might face upon entry...

- March 2016

- Free Access

Depending on the nature of the work that a company wishes to conduct within Singapore, additional documentation and licensing may be required. Among them, the most common ones are Business Activity License required for most firms operating within the...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us