Our collection of resources based on what we have learned on the ground

Taxation in a Company Acquisition Case in China

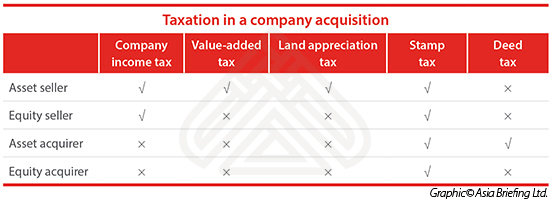

InfographicUnder the People Republic of China Corporate Income Tax (CIT ) Law, which applies to both domestic enterprises as well as foreign and foreign-invested enterprises, income arising from the transfer of equity and assets (both fixed and intangible) is subject to CIT. Different treatments and tax rates depend on the transactions types, payment methods and parties involved in the deal.

< BACK TO LIBRARY

Subscribe to receive latest insights directly to your inbox

Subscribe Now